Statement on HYBE Chairman Si-hyuk Bang’s CNN Interview

2023. 03. 03

The following is SM Entertainment’s response to HYBE Chairman Si-hyuk Bang’s CNN interview released on March 3.

Chairman Bang has distorted the definition of the term “hostile M&A”

In the interview, Chairman Bang stated that “a hostile M&A is the buying and selling of a company on the market against the will of the majority or dominant shareholder.” However, the term hostile M&A stands for the acquisition and merger of a company without the consent of the board of directors (not the majority or dominant shareholder), who have the legal responsibility to manage the company. Furthermore, a hostile M&A usually takes the form of a tender offer or a proxy fight, which is exactly what HYBE is attempting to do.

[ Definition of hostile M&A ].

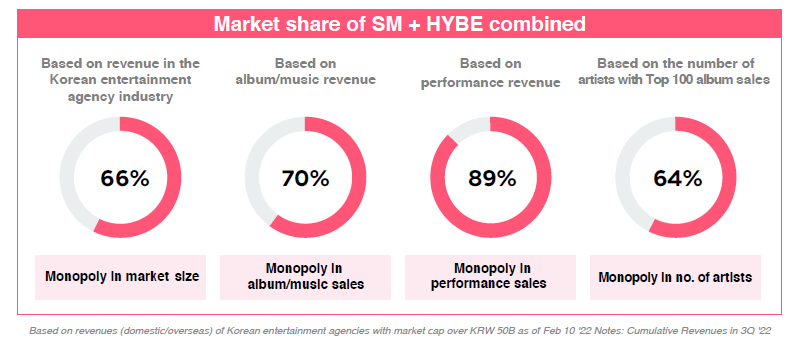

Chairman Bang has distorted the harmful effects of a “K-POP monopoly”

In response to criticism that HYBE is trying to take over the entire industry, Chairman Bang stated, “Even if the volume of CDs sold in Korea by SM and HYBE are combined, it would not be an absolute monopoly.” However, the merging of the two companies would create a monopolistic group that would account for about 66% of the total market revenue. A market monopoly of a single company will hinder diversity and fair competition in K-POP and lead to a decline in industry competitiveness.

[ Combined market share of SM + HYBE ]

HYBE’s governance structure is neither sound nor reasonable

In the interview, Chairman Bang pointed out SM’s governance issues and stated that HYBE has resolved most of these issues through the share acquisition. However, HYBE is attempting a hostile M&A of SM in partnership with Soo-man Lee, the former Executive Producer of SM, who has been the cause of the governance issues HYBE criticized.

Not only that, but HYBE has pledged KRW 10 billion to Lee’s tree planting project, which has already been the subject of several media reports, and KRW 70 billion to acquire stakes in two companies held by Lee. Most importantly, HYBE is conducting a hostile M&A that will cost more than KRW 1 trillion without any due diligence on SM.

The passing of such unusual resolutions makes us question whether HYBE’s Board of Directors is loyal only to its majority shareholder. As such, SM believes that HYBE’s governance is neither sound nor reasonable. We have serious concerns that SM will inevitably degenerate into an SM that exists only for the majority shareholder should HYBE’s hostile M&A succeed.

SM